Cryptocurrency-secured loans are in great favour on Bondster

April 22, 2022 For investors | News

Last year in autumn, we introduced loans secured by Bitcoin to our Bondster P2B marketplace. At first, we were concerned whether the loans on Bondster would be positively received by investors because we were aware of the controversy in society that usually accompanies cryptocurrencies as such. However, the need to innovate and constantly come up with new opportunities for investors prevailed, as we know they need to protect their savings from inflation now more than ever.

Over time, our decision proved to be correct. Six months after its launch, we can say with confidence that loans secured by cryptocurrency have gained great popularity among investors on Bondster. At the beginning of the year, we also introduced cryptocurrency-secured loans to the CZK market so that investors who prefer investments in Czech crowns could also participate. Now, it is possible to invest in cryptocurrency-secured loans in both euros and Czech crowns on Bondster.

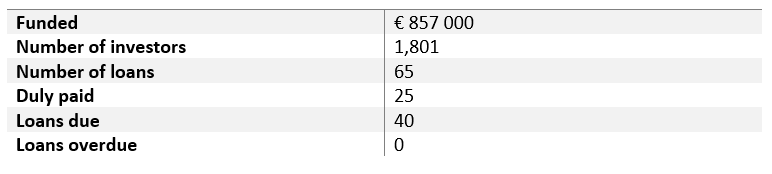

By the end of March 2022, over 1,800 investors had invested in cryptocurrency loans on Bondster with the total amount exceeding € 857,000. It is worth noting that a number of investors have already experienced a situation when the Bitcoin collateral was forfeited. As a result, they could experience first-hand that this outcome is favourable for investors in terms of the return as it leads to an earlier settlement and investors achieve a higher percentage return than they would in case of proper repayment. So far, collateral has been forfeited in 4 cases in which investors achieved an average return of 16% p. a. instead of the expected return of 10% p. a.

Bondster cryptocurrency loans statistics as of 31 March 2022

New loans also attract attention from abroad. Famous P2P influencer Angelo Colombo, who heads the Youtube investment channel P2P Investment EU, has recently emphasized the uniqueness of cryptocurrency loans and stated he is willing to allocate up to 20% of his funds on the platform in them.

We also believe that cryptocurrency loans investments have their place in a portfolio of a conservative investor who is looking for a well-secured fixed return sufficient to protect savings from inflation. Therefore, we will be happy to continue offering these loans on our Bondster markets.

How do investments in cryptocurrency-secured loans work?

Investing in cryptocurrency-secured loans is in essence no different from other types of investments on Bondster. The only difference is in the way of securing the investment. With these loans, borrowers pledge their Bitcoin instead of movable or immovable property. The fixed return on cryptocurrency loans is currently 10% a year on the euro market and 10.5% a year on loans in Czech crowns. It is important to mention that even if the price of Bitcoin drops significantly, the invested money is secured by collateral. The length of an investment is usually in the range of 1-12 months, which provides investors with an attractive level of liquidity. To learn more about these loans, read the article How not to lose money in crypto on our Bondster blog.

Lucie Volfová

Head of Customer Service Department

ACEMA

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.