October Promotion: Invest in ANVEST Loans and Earn up to 2% Cashback!

October 1, 2025 News

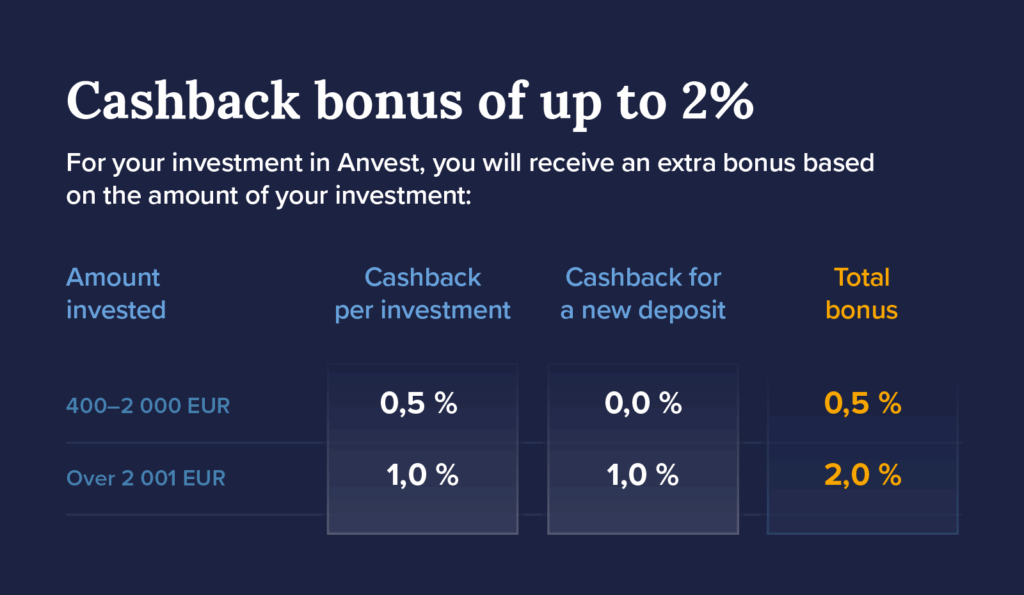

In September, we introduced the Slovak loan provider ANVEST to our offering. Only in October, in addition to a fixed return of 8%, you can earn up to 2% cashback on new investments. Take advantage of this opportunity and invest today.

Why invest in ANVEST loans?

On the Bondster platform, ANVEST offers exclusively real estate–secured loans. The collateral may include apartments, family houses, cottages, garages, building plots, or arable land. The loan amount never exceeds 70% of the property’s value. In the event of borrower default, the property is liquidated and the proceeds are used to satisfy investors’ claims. The combination of attractive returns and the security of real estate collateral ranks among the most sought-after investment opportunities on the market.

Key Features of the Investment

- Fixed return: 8% p.a.

- Investment in euros

- Annuity-based repayment

- Premium real estate in Slovakia

- Flexibility to exit the investment once a year

- Up to 2% cashback on investments from new deposits

Example: If you invest EUR 20,000 as a new deposit, you will receive 2% back, which means an additional EUR 400. The minimum cashback amount to be paid out is EUR 2. Cashback will be paid in the month following your investment.

About ANVEST

ANVEST has been operating on the Slovak market since 2013 and is headquartered in Nitra. The company specializes in business loans ranging from EUR 20,000 to EUR 2 million with maturities of 1 to 7 years. When providing loans, it emphasizes fast and discreet processing, expert advice, and an individual approach.

The company is financially sound and stable. Its registered capital amounts to EUR 500,000 and is fully paid up. ANVEST has no recorded debts, arrears, or liabilities towards the state. At present, it is not undergoing bankruptcy or restructuring proceedings.

Need more information?

We have the company’s presentation and its financial results prepared for you.

More about ANVESTBondster Evaluation

Based on the available financial statements, Bondster’s analytical team has assigned this provider an evaluation of B+. This gives investors another opportunity to diversify their funds among Central European providers.

Note: This offer is valid until October 31, 2025, and applies to all loans from the provider ANVEST on the primary market of the Bondster platform. The condition for receiving the “Cashback for Investment” bonus is to invest in ANVEST loans on the primary market before the end of the promotion. The condition for receiving the “Cashback for New Deposit” bonus is to deposit new funds and invest them in ANVEST loans on the primary market. The bonus will be paid out by the end of the month following your investment. If you make multiple deposits or several investments in ANVEST loans within a single month, the cashback will be calculated from all such deposits and investments.

Author: Roman Muller

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.