Create your own investment strategy and let the returns grow!

November 2, 2023 For investors | Tips and advice

On the platform BONDSTER, you can easily set your own rules for investing in loans. Create your own investment strategy and simplify your portfolio management. We will show you a model example of setting up a custom strategy.

On the platform BONDSTER, investments in loans from over three dozen verified providers from across the world are available. The range of investment opportunities is wide and individual loans differ not only in the amount of the fixed return but also, for example, in the maturity period or the method of collateral.

There are three ways how you can select loans for your investment portfolio: manually, automatically through a preset strategy or by using a custom investment strategy. The last option offers the greatest flexibility, as you can determine yourself which loans to invest in. This strategy can be 100% tailored to your investment profile and goals.

Creating a custom strategy

We will take you step by step. First, log in to your investor account and click on the “STRATEGY” tab at the top menu of the page.

If you don’t have an account yet, you can easily create one here.

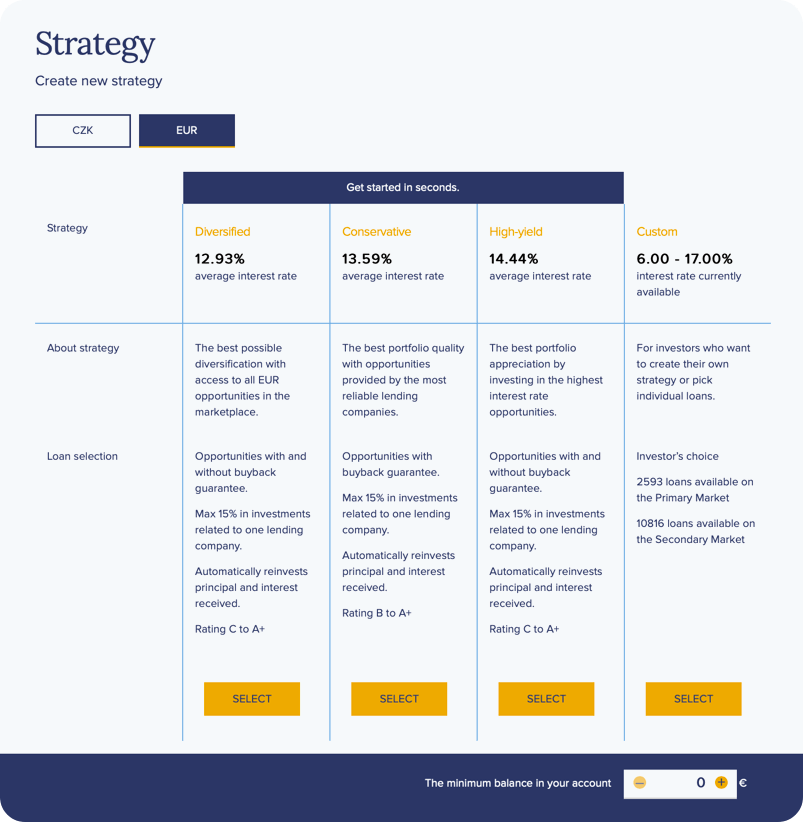

Create an accountYou will see a page with a list of available strategies for investing in Czech crowns and euros. In our guide, we will focus on investing in euros, so select the EUR option. Next, you will see four strategies: the first three are preset and the last one is custom.

You can choose a custom investment strategy by clicking the yellow “SELECT” button. Now you can start setting specific parameters of your own strategy.

Setting up a custom strategy

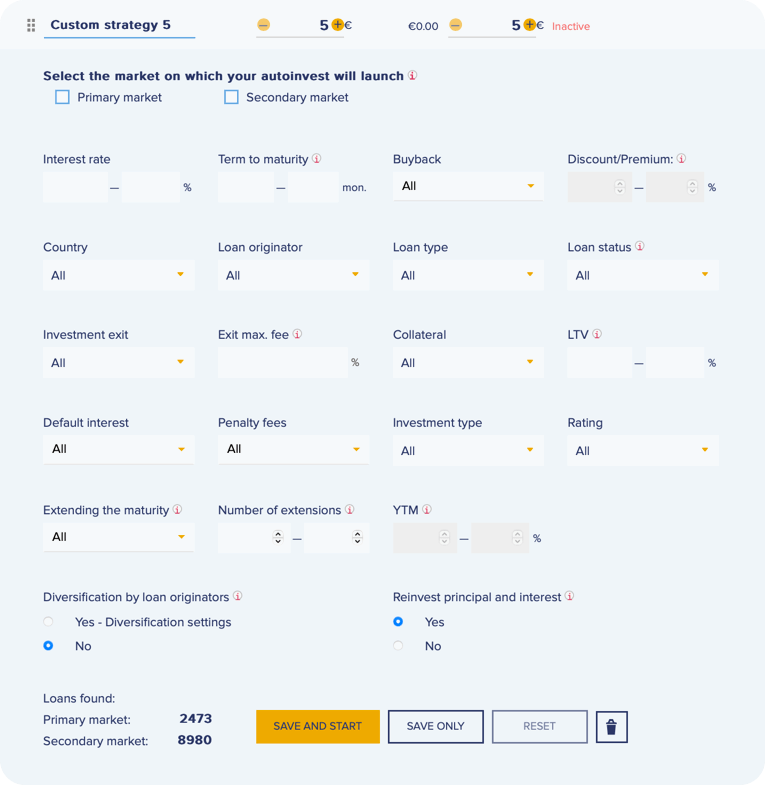

The online form for setting up your own strategy contains a number of parameters. It is a good idea to fill in the “Strategy name” field on the left in the header of the strategy settings. If you have multiple strategies, the names will help you navigate through them better.

Next, you need to fill in the target amount, which is the maximum amount you plan to invest within the strategy. You also need to choose the maximum investment in one loan. On the platform BONDSTER, one can start investing with as little as 100 Czech crowns or 5 euros. Thanks to the low minimum investment, it is possible to diversify the portfolio very thoroughly, both at the level of individual loans and providers.

For a custom strategy, you will also need to choose whether you would like to invest in loans on the Primary or Secondary Market, which providers you are interested in and what interest rate or loan maturity you require.

Loans can also be chosen by how they are secured (e.g. real estate, cryptocurrency, car, etc.). Loan providers may also offer the so-called buyback guarantee or allow early withdrawal from an investment.

Don’t forget about reinvesting the principal and interest payments received

In the strategy settings, ticking the box to “Reinvest principal and interest” is very important. Once you check this option, the money credited to you is quickly reinvested, earning you additional interest on the interest earned and thus maximizing your interest income.

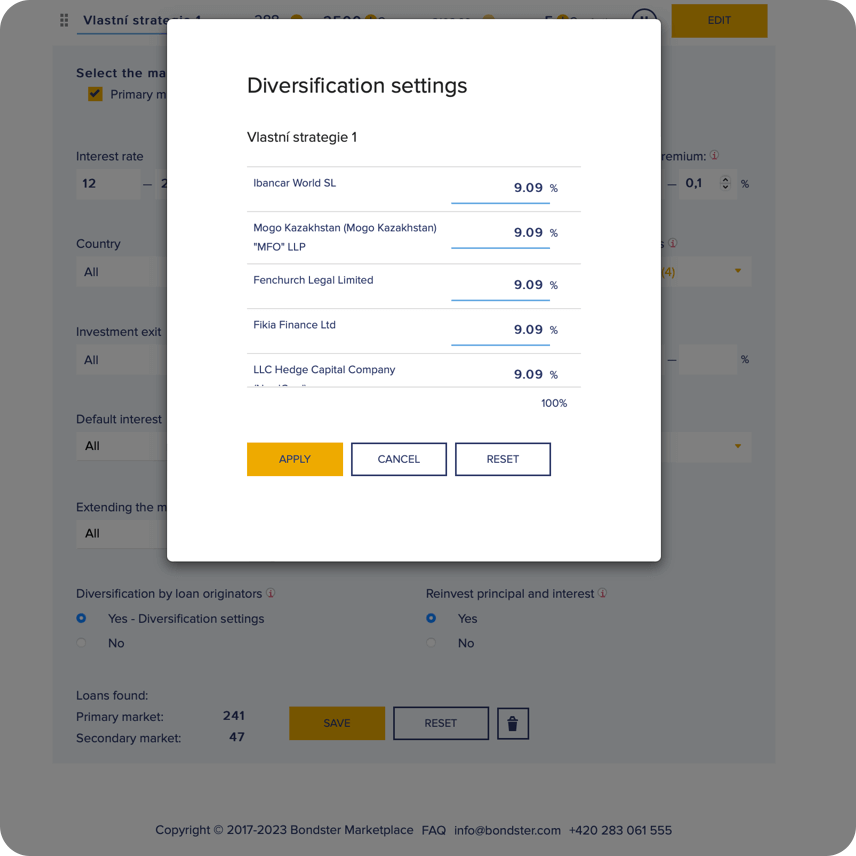

The possibility of automatically diversifying the portfolio by providers is also useful. You decide for yourself what percentage of your total free funds available for investment you want to invest in loans from individual providers.

inally, you need to save and run the created custom strategy. You can modify the set strategies at any time by pressing the “EDIT” button.

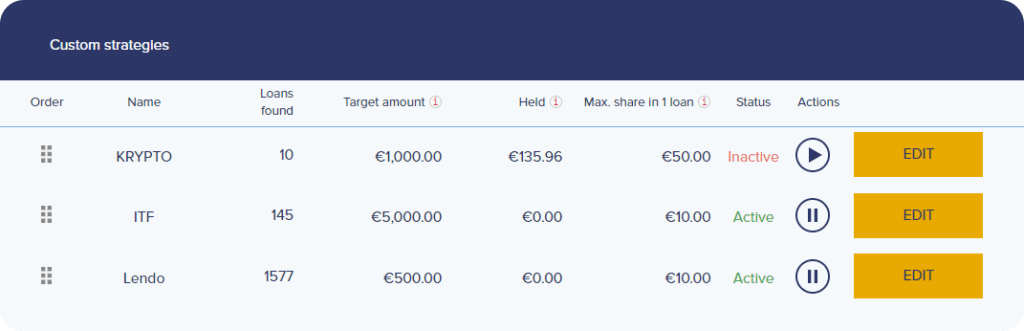

It is also possible to create multiple strategies. Just remember that the order of the strategy in the strategy overview is very important as it determines the priority of selection (strategies are executed from top to bottom).

Creating a model custom strategy

Now, we will show you a possible setting of a custom investment strategy. The model strategy presented here only serves as an example. In total, we will create four custom strategies.

Imagine a situation where you have three favourite loan providers. In our model case, these will be ITF Group JSC and Lendo. We will set up a separate strategy for each of them. The last, third strategy named Own Strategy is for the case when none of the above-mentioned providers have free loans to invest in.

The order of individual strategies determines their priority. In our case, loans from the provider ITF Group JSC are selected first, then loans from Lendo and only then loans that match Own Strategy are chosen.

Now, we will show you how one could set up a strategy for the provider ITF Group JSC.

Strategy for the provider ITF Group JSC

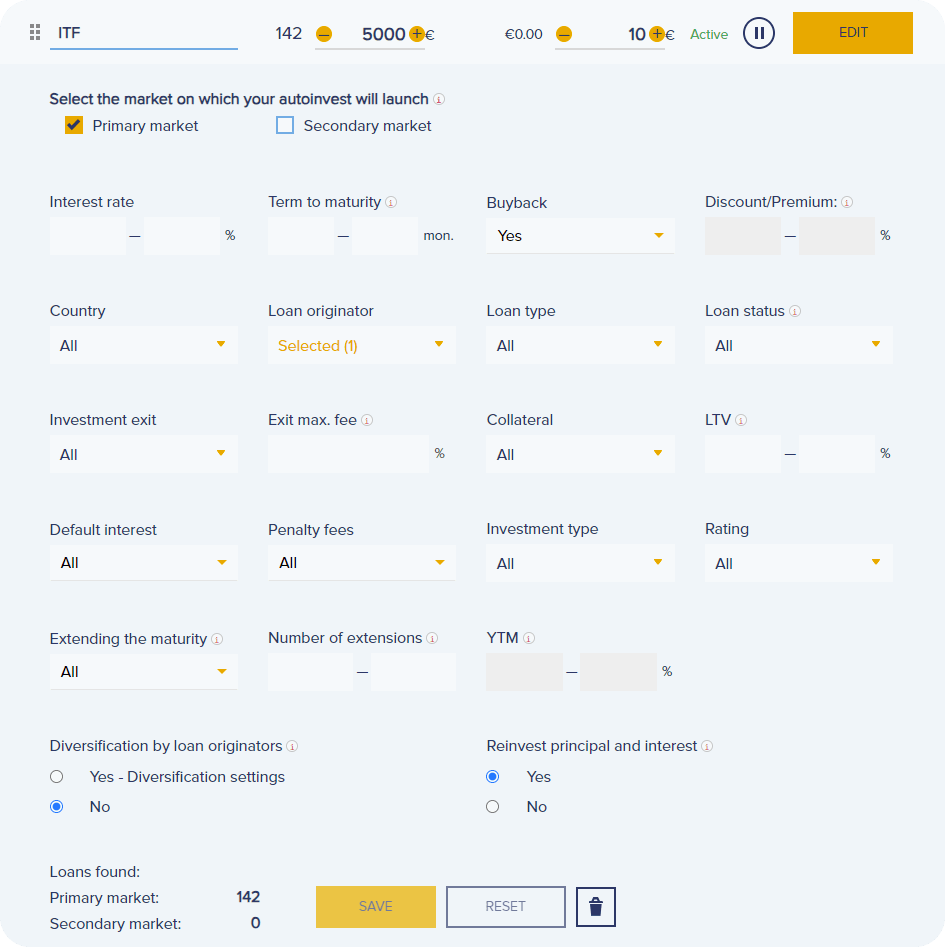

In the name of the strategy, we simply indicate the provider’s name, ITF. We set the target amount to EUR 5 000 and the maximum investment in one loan to EUR 10, for example.

From the loans issued by ITF, we select, for example, loans with an interest rate of 12 to 14 per cent, and a maximum of 36 months remaining until maturity.

We check ITF in the list of providers. Since we are setting a strategy for selecting loans from one provider, diversification by providers does not make sense and therefore we check the NO option.

We would like the credited principal and interest to be reinvested as soon as possible, so for “Reinvest principal and interest”, we check the YES option.

Finally, we save the settings with the “SAVE” button.

Similarly, we have set up strategies for the providers Alende and Lendo.

Strategies for selecting loans from multiple providers

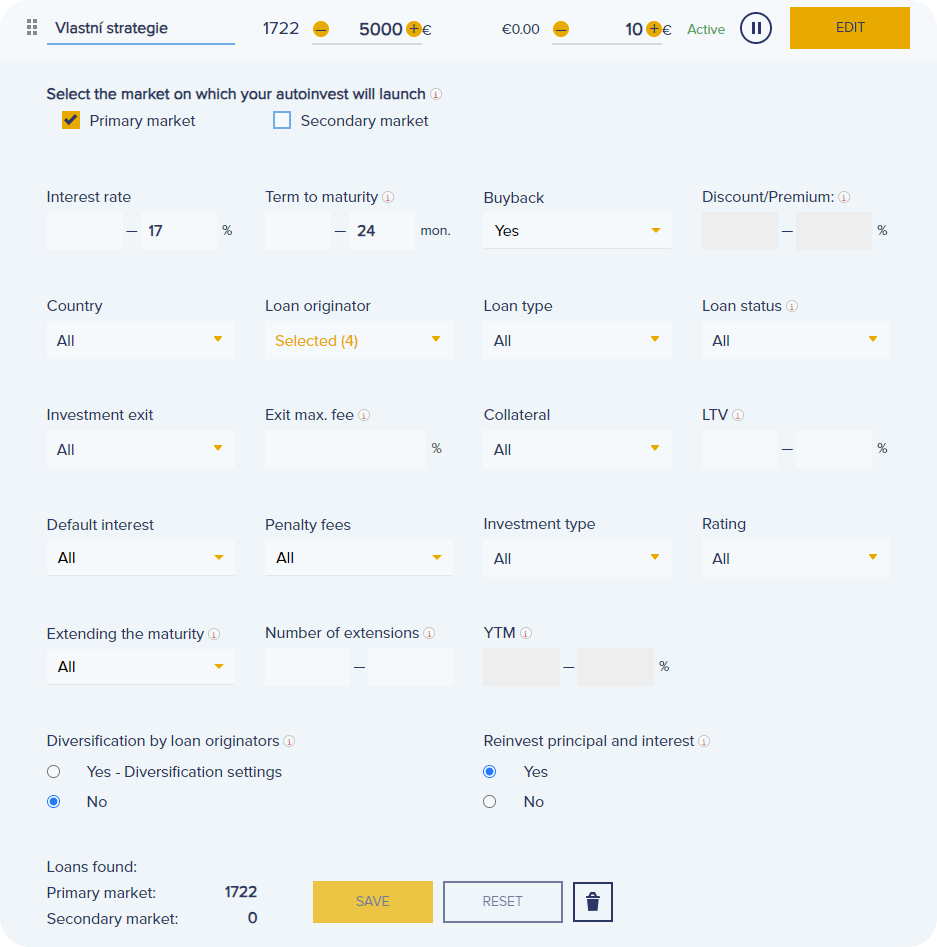

The third strategy, which we will name Own Strategy, contains providers whose loans should be chosen automatically if there are no loans from the providers ITF and Lendo available.

We have added four more providers to the strategy. The interest rate of loans is set up to 17%, the maturity period is a maximum of 24 months, and the provider is required to offer a loan buyback guarantee.

Benefits of using a custom investment strategy

By setting up your own investment strategy, you can save a lot of time. Compared to manual investing, you do not have to constantly monitor the offer of loans and choose the most suitable ones for you, and if necessary, you can modify or cancel the settings of individual custom strategies at any time.

Autor of the article: Roman Muller

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.