Loan investments on Bondster are outperforming stock markets

March 28, 2023 For investors

The average annual return on investments in loans on the platform Bondster reached 13.5 per cent over the past year while equity markets lagged significantly over the same period.

Stocks and P2P investments are two completely different worlds. The first-mentioned investment asset can bring quick profits and losses, while the second brings the certainty of a fixed yield. Read more about the specifics of investing in stocks and loans and what their respective performance was over the past 12 months.

Investing in stocks is like a roller coaster ride

If you buy shares on a stock exchange, you become a shareholder of a company. If the company is successful, the stock price goes up, and if you can sell at the right time, you will make a profit. Moreover, during the period of holding the company’s shares, you can also regularly receive a share of the company’s profit in the form of dividends with some companies. However, if the company is not doing well and investors are losing interest in its shares, their price falls. The loss from stock investments can be substantial.

Shares of global brand companies are not immune to significant losses either.

Take the American car manufacturer TESLA, for example, whose shares lost more than 38 per cent in 12 months. (the period from 21 March 2022 to 20 March 2023)

High volatility is to be expected in the stock market. While at one moment you can make fabulous profits on stocks, at another you can quickly lose a significant part of the money you invest. Because of the higher volatility, stocks are suitable for investors with a higher tolerance for market risk and a long investment horizon.

P2P investing delivers stable returns

P2P investments have zero volatility compared to equities, making investing in these assets much calmer. Like bonds, investments in loans yield a fixed return and have a fixed maturity (from one month to 20 years). With a platform like Bondster, you can easily invest in different types of loans provided to your clients by proven lending companies operating in different parts of the world.

As an investor, you share in the interest yield on a particular loan. On Bondster, the return on investment ranges from 7 to 17 percent depending on the type of loan. A portion of the principal and interest for the corresponding period is credited to your investor account in regular monthly installments. When you reinvest the interest earned, you take advantage of the compounding effect to achieve an even higher total return. P2P investments are also suitable for beginners and less experienced investors.

Comparing the performance of equities and P2P investments

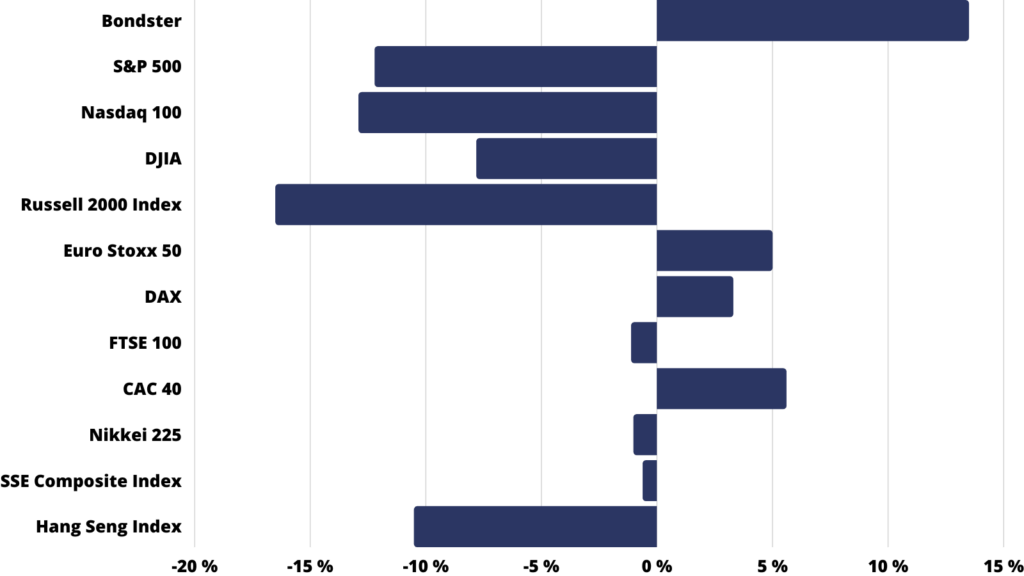

Over the last 12 months (note: the period from 21 March 2022 to 17 March 2022), the stock markets as a whole have not performed well. At best, European markets have only appreciated by a few percentage points. For example, the CAC 40 index of the French stock market gained just 5.6 per cent during this period. Similarly, the fifty largest European companies in the Euro Stoxx 50 index rose by 5 per cent.

Stock markets in the US and Asian countries dipped into negative territory. The most followed index of US stocks, the S&P 500, lost over 12 per cent. Stocks included in the other two most followed indices, the DJIA and the Nasdaq Composite, also fell (note: down 7.8 and 16 per cent respectively).

A much more attractive view of P2P investment returns. Over the same period, the average return on investment in loans on Bondster climbed to 13.5 per cent.

Investments at Bondster vs. the development of the major world indices:

Source: Google Finance

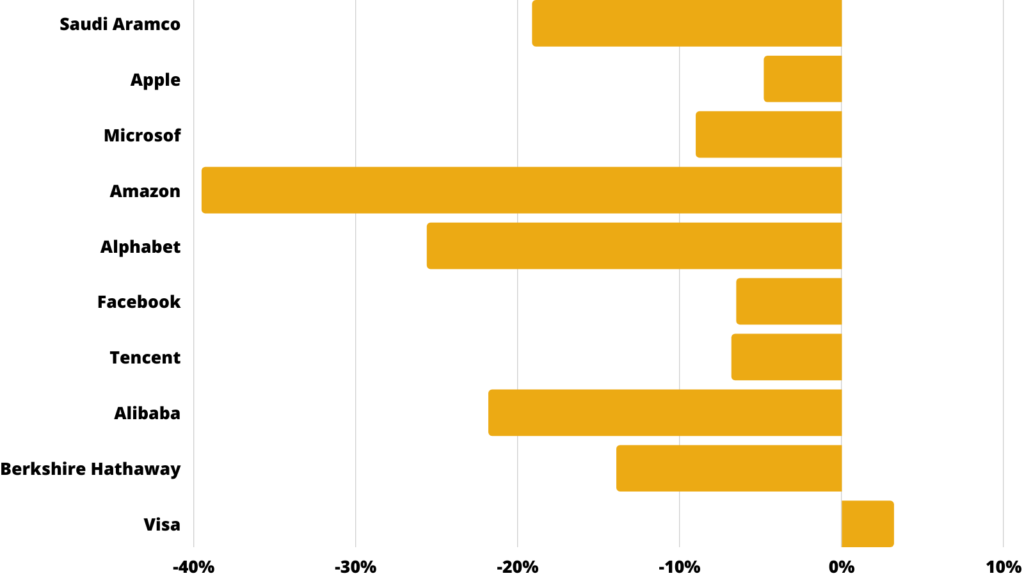

The return on Bondster was higher than the one on Warren Buffett’s company stock

Investments in loans on Bondster outperformed even the top ten companies by market capitalization. For example, Apple shares lost nearly 5 per cent over the past 12 months. The shares of Amazon (-39.5%), Alphabet (-25.6%) and Alibaba (-21.8%) were down significantly over the same period. The shares of Berkshire Hathaway (-13.9%), partially still run by the renowned investor Warren Buffett, also ended in the red.

Annual share price development – the largest companies in the world by market capitalization:

Source: Google Finance

P2P investments are well-secured

Stock returns are always uncertain, and trading can lead to significant financial losses. Bankruptcy and termination of a company’s activities also cannot be ruled out. These and other risks can be however reduced by carefully picking individual stocks and sufficiently diversifying your investment portfolio.

Investing in loans on Bondster offers various forms of security in case the borrower defaults on the loan. The strongest form of securing an investment is by collateral, i. e. when the loan is secured by a piece of real estate, for example. In case of non-payment of the loan, the pledged property is sold and the investors’ claims are settled. Loans on Bondster can also be secured by a car, other movable property or cryptocurrency.

There are also unsecured loans offered on the platform, although the vast majority of providers offer the so-called buyback guarantee. It means that if a loan is in arrears for more than 60 days (30 days in some cases), the loan provider buys back the unpaid share of the principal from investors, and also pays them the remaining interest, including for the whole period of the delay.

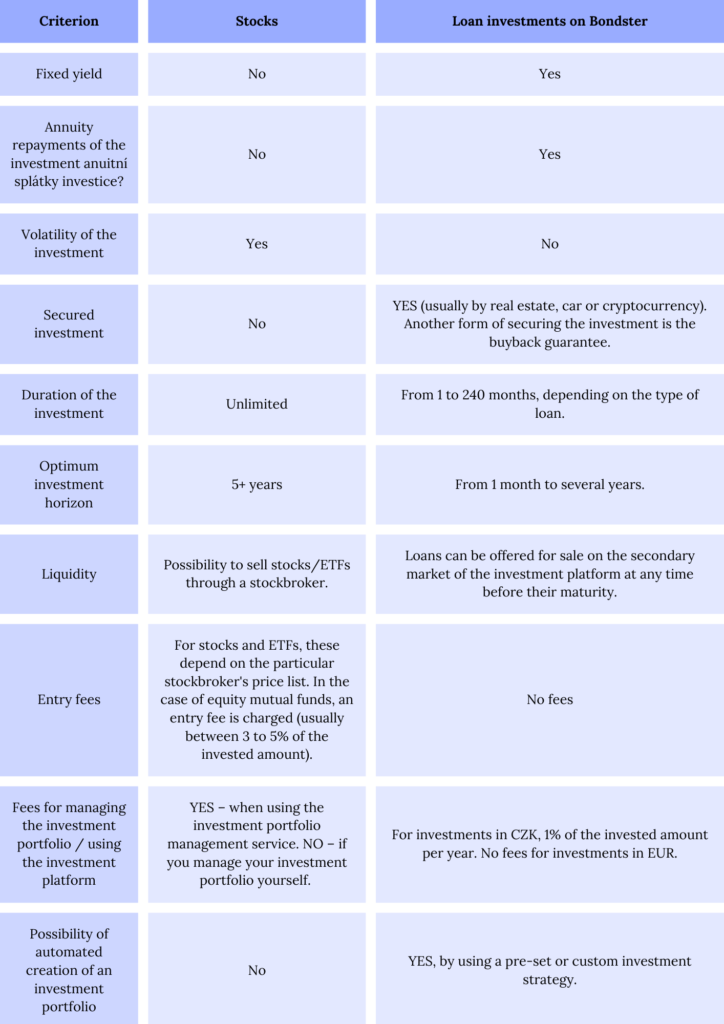

A broader comparison of stock investments and investments in loans on the platform Bondster

P2P investments or Stocks?

Although stocks and P2P investing are two fundamentally different investments, both options have their place in the modern portfolio. Loan investments are a smart step in diversifying one’s portfolio. P2P investments should represent between 5 to 10 per cent of the portfolio, depending on the investor’s risk appetite.

Author of the article: Roman Muller

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.