How to diversify a portfolio on Bondster: Preset investment strategies and Autoinvest

March 31, 2022 For investors | Tips and advice

Diversification constitutes an integral part of managing your investments. Standard mechanisms and rules that apply to investing in general, apply to investing on Bondster as well. Their specific implementation, however, differs slightly in the case of P2P platforms, as you do not build your portfolio from standard types of investments, such as stocks or bonds, but from loans offered on the platform. When investing on Bondster, you can use Autoinvest and the newly launched preset investment strategies to help you diversify your portfolio. How do they work and what are their benefits? Read on.

How the preset investment strategies work

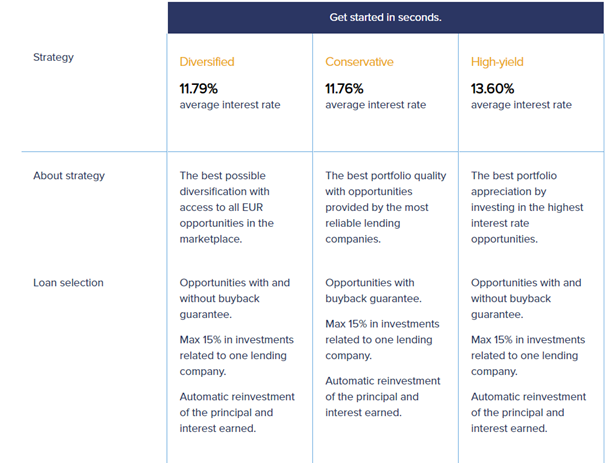

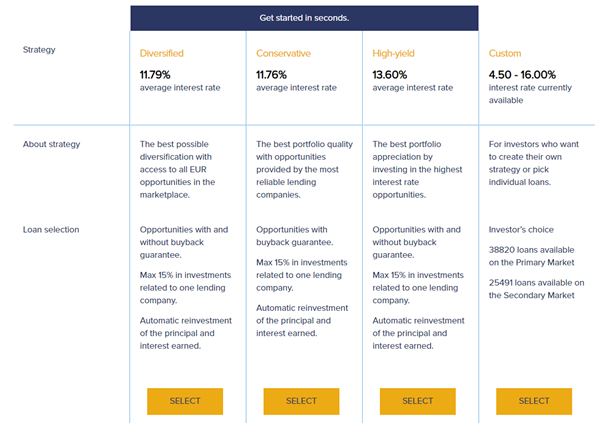

When using automated investing, you can choose from three strategies for the euro market and two strategies for the Czech crown market. We recommend starting with strategies for the euro market and choosing the one that best suits your investment profile and horizon. Strategies vary according to your preferred risk and return, with all three strategies applying the principle of thorough diversification. Especially novice investors may not be fully aware of the benefits these strategies offer, such as that they save a lot of time and help create a broadly diversified portfolio.

The invested funds are divided into many loans, with a maximum of 15% invested per provider. A maximum of 20% is invested in one loan. The strategies also observe the rule of not investing more than 15% of funds with one provider. Therefore, if you invest €100 using one of the strategies, a maximum of €20 will be invested in one loan. In all strategies, the returns are automatically reinvested. Each strategy also includes a assessment in letters that tells investors how financially strong each provider is. Read more about the assessment and how it is assigned.

High-yield strategy

This strategy aims for building a portfolio with the highest return by investing in loans with the highest interest rates which are usually secured by a buyback guarantee, but not always. Loans across the whole euro market are used. To rate providers, a letter grading scale is used that ranges from C to A+. The strategy automatically reinvests returns which reach about 13.6% per year.

Conservative strategy

Invests in loans from the most reliable providers with a assessment between B and A+. Eligible loans always include a buyback guarantee, and their returns are automatically reinvested. The average annual return on this strategy can reach 11.76%.

Diversified strategy

This strategy offers the best diversification possible and uses all loans offered on Bondster Marketplace. It invests in loans with and without a buyback guarantee and reinvests the principal received including interest. The assessment of providers for this strategy ranges from C and A+.

Try out the Diversified strategy or other Bondster strategies that will save your time, diversify properly and generates high returns.

Autoinvest can help with diversification (Custom strategy)

In addition to the preset strategies, you can also use Autoinvest to help you diversify your portfolio. We have incorporated a number of settings into the Autoinvest tool so that you could tailor your portfolio to your liking. You can invest in loans in crowns from CZK 100 and in loans in euros from €5. There are currently thousands of loans on Bondster’s Primary and Secondary Markets. New loans are regularly added to the platform.

A wide range of loans and a very low minimum investment make it possible to significantly spread the risk. Even with a small portfolio of 1,000 euros, you can buy up to 200 loans with different maturities and from different providers. A good thing to know is that you can invest in these 200 loans automatically by using Autoinvest. In general, the more instruments your portfolio includes, the lower its fluctuations are. However, the biggest benefit of diversification is when the portfolio is divided into approximately 50 investments. With each subsequent investment, the diversification benefit grows more slowly.

Investors also need to think about the loans they invest in. It is crucial to ensure that funds are allocated among loans from different providers. If you use Autoinvest, do not forget to update it regularly so that it also includes loans from new providers. On Bondster Marketplace, you can find loan providers from different regions, with different client approaches and loan parameters.

Another rule of investing is to diversify in time, i.e. to buy loans with various maturities. This will make the flow of income to your account more stable. Even if a single loan repayment is delayed, the flow of money will be partially offset by other repayments arriving in the account. Where can you find Autoinvest? Click the Strategy tab in your investor’s account and you will find it in the last column titled Custom. Click the Select button at the bottom and proceed to set up your investment preferences.

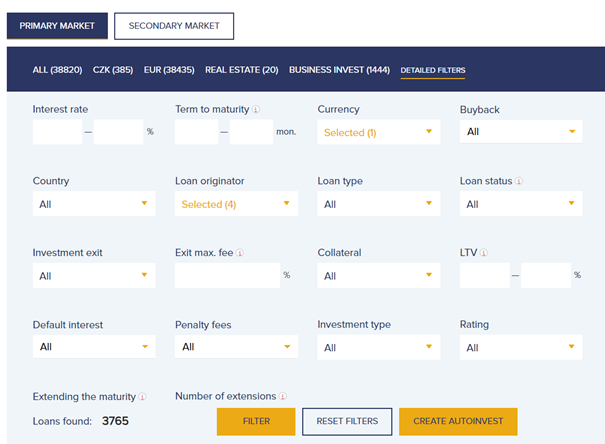

You can also find the Autoinvest tool under the Investments Offer tab. Click the Detailed Filters tab which allows you to set your investment criteria. Once this is done, click the Create Autoinvest button below. A window will appear where you can check your settings, name your new Autoinvest, set the target amount and confirm your choices.

Diversification by liquidity

Your liquidity preference constitutes another important criterion when choosing loans to match your investment profile. In other words, what is the latest time you are comfortable turning your investments into cash if necessary. Bondster offers a range of loans with various maturities, so there is a lot to choose from.

Moreover, Bondster offers a unique possibility to withdraw from an investment before its maturity for a fee ranging from 0% to 2%. Investments can usually be terminated on a monthly, quarterly, semi-annual and annual basis or even at the discretion of the investor. Therefore, if you suspect you might need to withdraw your invested funds in the future unexpectedly, we recommend choosing especially the loans that come with the immediate liquidity guarantee feature. If you have a longer-term horizon, you can choose your investments from the entire investment offer.

Diversification by providers

There is a certain amount of risk associated not only with individual loans but also with providers, some of whom might fail to meet their obligations. From an investor’s point of view, this scenario may include situations when the company goes bankrupt, does not make buybacks as obliged or fails to allow investors to withdraw from an investment. We have rated all providers to help our investors make informed decisions about which providers to invest in.

The assessment assigns providers a letter on a scale from A+ to D, where A+ indicates the lowest level of risk with the highest ability of a provider to meet its obligations. On the contrary, a low assessment of a C- is assigned to providers that have a very high probability of failing to meet their obligations or there is a high risk of other interruptions in their operation. The letter D is intended for providers who have already experienced a more significant delay in fulfilling their obligations. Our Risk Department prepares a thorough analysis of each provider and performs quarterly monitoring of all providers. Find out how the assessment is assigned.

Several criteria are looked into when assessing a provider. The better the company’s financial results, the lower the risk of its bankruptcy, as it has been probably able to create more reserves for hard times and cover non-performing loans. Investors, however, do not have to worry too much about the bleakest scenario in which the provider goes bankrupt. Should this happen, their share of the loan and all its essentials remain the same while Bondster undertakes the role of the provider itself. However, this process can take up to several years to settle. In reality, this means that Bondster continues to manage or recover the loan while everything stays the same for investors. All companies that are currently offering loans on Bondster are scrutinized by the Risk Department, which rates them according to the information available. Investors can then use the assessment to understand the risk associated with every particular investment.

Authors: Petra Halíková, Vladimír Vála

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.