Invest in Smart Finance loans in September and earn an attractive 17% interest

August 31, 2023 For investors | News

The full name of the fintech company is MFO Smart Finance LLP, and it was established in May 2019. In Kazakhstan, it focuses on providing online microloans under the Money Express brand. For the month of September, the provider has prepared a special offer of loans yielding an attractive 17% interest.

Smart Finance joined our providers on Bondster in April, and after assessing its financial statements and business model, we assigned the company a B+ assessment.

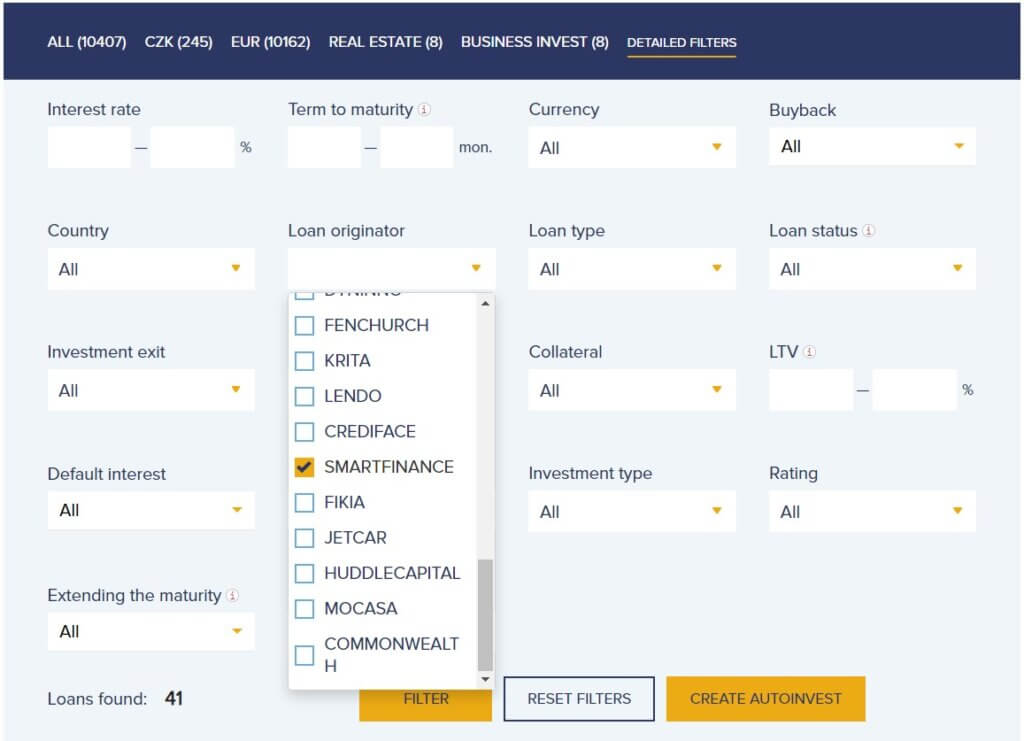

This September, you have a unique opportunity to invest in loans with an increased 17% interest rate (note: as long as these are available). To see the loans that are being offered for investment, log in to your investor account and click the INVESTMENTS OFFER tab. To manually search for loans available, we recommend using the Detailed Filters option. In the Loan Originator field, select SMARTFINANCE and then click the FILTER button.

In a short period of time, Smart Finance, which provides online microloans under the Money Express brand, was able to transform from a small startup into a medium-sized, stable and profitable company. From October 2019 to June 2022, the company provided more than 49,000 loans in the amount of over 2.3 billion tenge (note: over USD 5 million).

To run its activities, Smart Finance obtained a license from the state Agency of the Republic of Kazakhstan for the Regulation and Development of the Financial Market and is also a member of the Association of Microfinance Organizations of Kazakhstan.

The age of the average Smart Finance client is 34 years. In terms of gender, there is a slight preponderance of women in the client portfolio (54%). Over 80% of the provider’s clients live in cities. In the dollar equivalent, successful applicants can get a microloan in the amount ranging from USD 20 to USD 370, with an average loan of USD 100. The minimum term of a microloan is 10 days, the maximum is 20 days.

Arranging a microloan takes place completely online. The applicant only needs to fill in the application form and sign the contract on the Money Express website. If approved, the money is immediately disbursed to the applicant’s bank account. Thanks to the use of modern technologies and automation, this process takes no longer than 15 minutes.

For Smart Finance, providing high-quality services is paramount. To do that, it uses state-of-the-art technology and constantly strives to improve its internal processes. The goal is to provide money to eligible clients quickly and easily.

Those interested in getting a microloan can expect their creditworthiness to be thoroughly assessed. The company makes sure that its prospective clients will have no problems repaying their loans. As for new clients, only about 10% of applications are approved. Returning customers are more successful in this regard, with the percentage of approved applications reaching about 70%. By using this approach, the company tries to help clients build a positive credit history and strengthen a long-term relationship built on trust.

We recorded a video interview with Smart Finance that you can watch here.

Author of the article: Roman Muller

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.