Time to check your investment portfolio settings!

February 5, 2024 Tips and advice

Failure to comply with the buyback guarantee by the provider or its default affects the overall performance of the investment portfolio. Let us show you how to approach investment diversification and maximize your expected return.

In December 2023, we informed investors about the delay in the disbursement of funds due to non-compliance with the buyback guarantee by the loan provider Right Choice Finance. We are currently taking legal steps to collect all investors’ claims. As a result, we recommend our investors to check their investment portfolio settings.

In order to eliminate the financial impact of possible non-compliance with the buyback guarantee or default of the provider, it is important to pay particular attention to proper diversification of investments. To maintain attractive returns in the long term with the lowest possible risk, it is important to allocate the money in the BONDSTER investor account into different types of loans from a bigger number of providers.

What to look at when choosing loan investments:

- Loan collateral

- Guarantees from the provider

- Loan provider assessment

- Loan default rate

If a provider defaults on its obligations to investors, for example, due to its difficult economic situation, or national or international sanctions preventing cross-border transfers of funds (e.g. from the Russian Federation), proper diversification can ensure that the impact on the overall performance of the portfolio will be minimal.

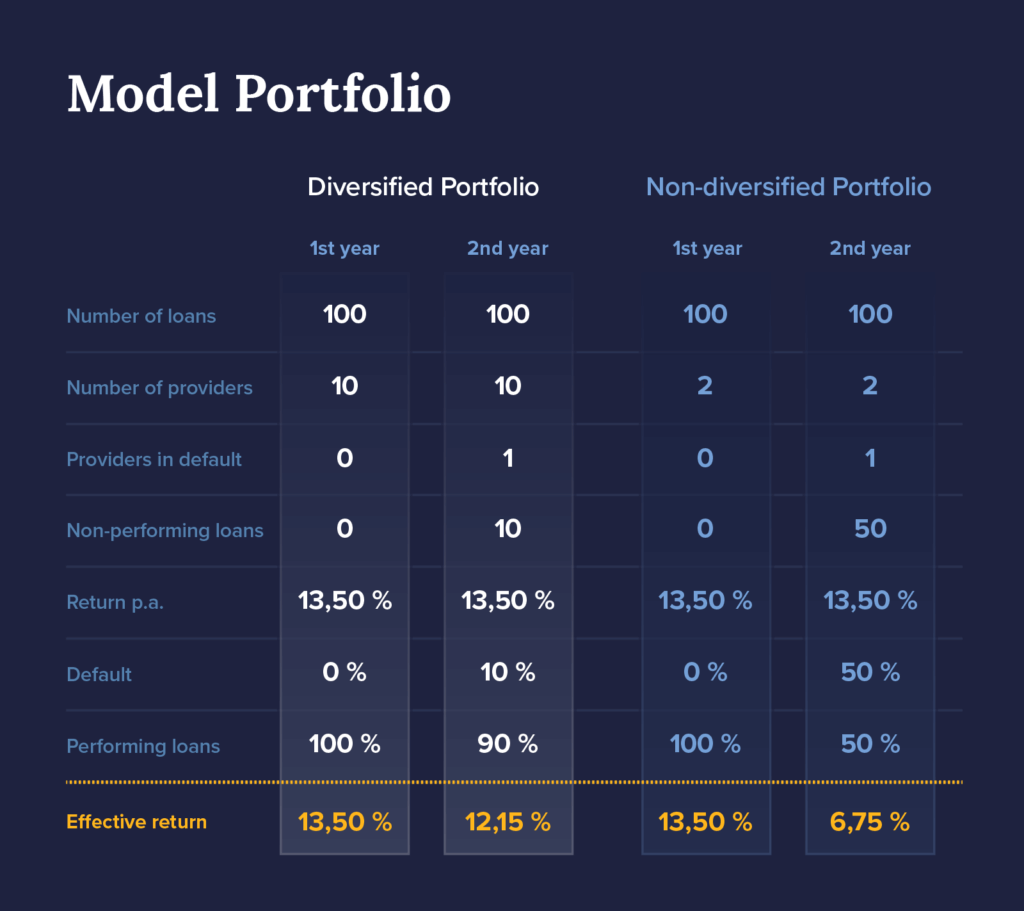

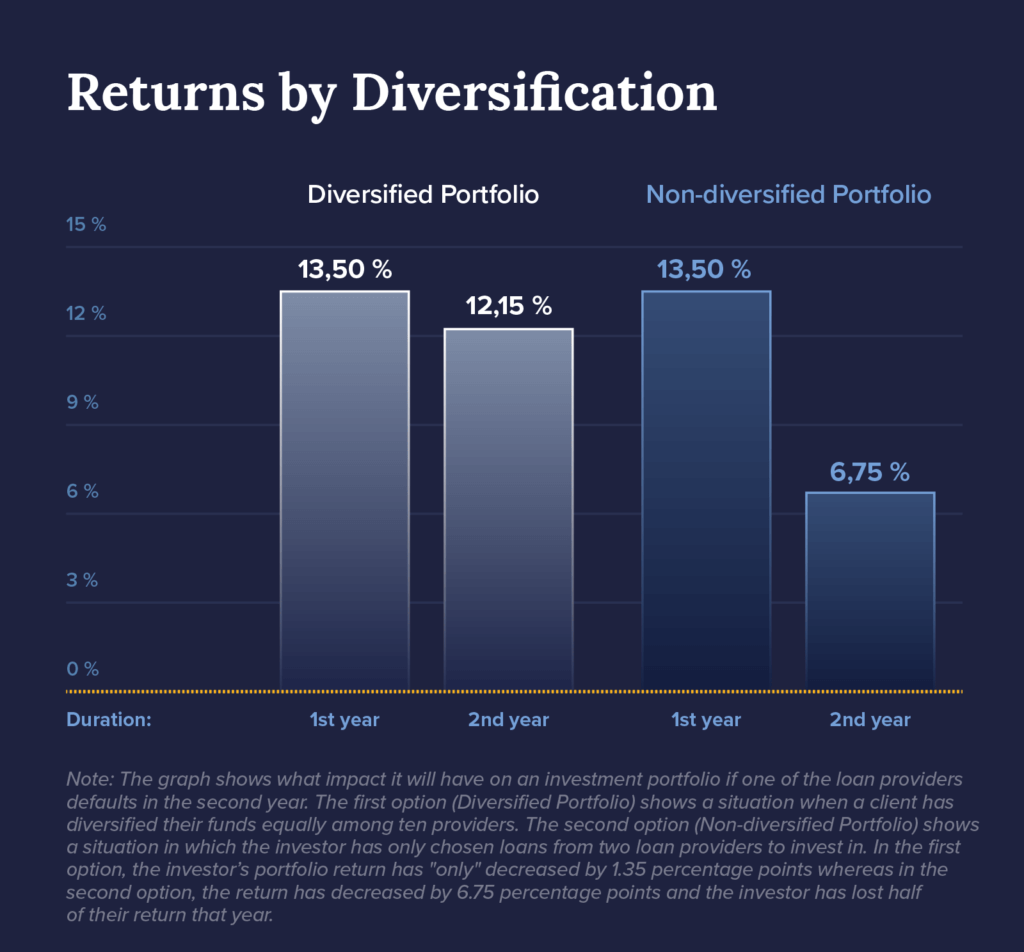

The following comparison shows the difference in the expected return of a diversified and non-diversified portfolio.

You can manage the expected return and risk by setting your own investment strategy. You can easily decide which loans and providers you want to invest in. Setting up your own strategy is described in detail on our blog HERE.

There are several thousand loans available on the platform BONDSTER. Among the safest are investments in loans that are secured by real estate, a car or other property. In case of non-payment of the loan by the borrower, the collateral is monetized, and the funds obtained are used to satisfy investors’ claims.

The BONDSTER analyst team sets a credit risk assessment for each provider, after evaluating a number of financial and non-financial indicators. The assessment of individual providers is published and regularly updated in the Provider assessment section.

Author of the article: Roman Muller

Share the article

Most read articles

All articlesDo you like our articles?

Subscribe to the newsletter and do not miss a thing from the world of investment. By subscribing, you consent to the processing of personal data.